Stop Being Cast as the Villain

Carriers and their Adjusters Run Plays from their playbook.

Their Game Plan includes a play that casts the contractor as the VILLAIN.

Their entire Game Plan is devised to pay as little as possible and to cause you enough problems so you give up.

The Claim is a Game - It's Won by Running the Right Plays

Carriers play to win, they don't always play fair - but most claims turn on predictable mistakes and missed leverage points most contractors never see.

Quit wasting countless hours and TONS of money Trying to get Paid fairly

Carriers don't manage claims one decision at a time.

They manage through patterns, studying their opponent and devising a Game Plan to win the claim.

Carriers Know:

That insureds are not represented, they do not read or understand their insurance policy, they don't know the Rules for the Game.

That Contractors do not Read or Understand the policy, the Rulebook and do not use it to their advantage

That most Contractors don't know the REAL Game, don't have a Game Plan for the REAL Game, and have few if any answers for the Carrier's plays.

How to Stymie the Claim Process to draw out the claim knowing that time is the carrier's friend and insured's & contractor's enemy.

That Insureds grow increasingly impatient with time making it easier for Adjusters to run plays that cause the insured to turn on their Contractors.

Insureds can be easily persuaded to doubt and to lose trust in their Contractor due to the plays the carrier ran early in the Claim Process.

Contractors can be made impatient by Adjusters running plays that cost the Contractors time, resources, profits

Where Contractors tend to concede.

Time causes Contractors to lose patience leading them to concede costs and proper restoration in favor of putting an end to the pain, taking what profit they can, and moving on.

When Contractors concede work and money to the carrier, they will do less work & still profit making the decision to concede predictable.

That Contractors rely on the advice given them by Poorly trained individuals that pretend to know the Rulebook.

That the Contractor has bought in to the way the carriers play the Game

That the word NO can cause the claim into a tailspin and care scare the passengers who fear a crash, regardless of whether the No is reasonable or not.

You didn’t become a contractor to manage insurance claims or appease unfair adjusters requests.

We can reduce that burden so you can focus on completing projects and making money.

No Pilot Experience Required

MyClaimCoPilot

Claims Rarely Crash Due to a Single Moment

Claims DRIFT - Through Delay, Misdirection, & Predictable Pressure Points.

Adjusters shape insured expectations.

Their conversations are framed to create risk and cause fear.

Costs are denied, not always just because they're unreasonable, but because time works in the carriers favor.

Carrier's Game Plans often purposely omit Policy Language, or simplify it, or misuse it, or misrepresent it - knowing contractors won't challenge it for fear of being cast as working as an unlicensed PA.

And because the contractors' game plan is often to take control of the claim away from the insured, the insured won't challenge it either.

The contractor is kept busy, their effort is REAL - but the contractors effort is REACTIVE

Reactive is exactly what the carrier's playbook is designed to produce.

The Question That Actually Matters

If claims are piloted by the carrier —

and if the carrier already knows where they plan to land —

Can you influence the flight without arguing coverage, negotiating claims, or acting as a public adjuster?

That question is where most contractors get stuck.

It’s also where the MyClaimCoPilot System begins.

Control doesn’t come from confrontation.

It comes from running the right GamePlan and the right plays — at the right time.

What changes outcomes isn’t who argues the claim.

It’s how and by whom the claim is piloted -

It’s about never getting to an argument at all -

It's about who controls the sequence before the argument ever begins.

That’s the gap most solutions never address.

A proven claim workflow is a well piloted claim —

turning chaos into clarity and clarity into revenue.

Buried in Paperwork!

Unfair Adjuster Estimates and Too Much Time Wasted.

Buried By Unreasonable Adjusters & Requests?

Tired of Promises from PAs, estimate writers, who get marginal results?

Quit wasting countless hours and TONS of money Trying to get Paid fairly

You didn’t become a contractor to manage insurance claims or appease unfair adjusters requests.

We take that burden off your desk, so you can focus on completing projects and making money.

See the Game change when you implement Your Own GamePlan.

Does this sound familiar?

Problem: Contractors relying on someone that used to be an adjuster.

Most adjusters are trained by the carriers and think they know inside information.

If you know claims than you know many, if not most, adjusters are poorly trained.

Most Public Adjusters willing to take on small residential claims are wannabees.

The best PAs are sought after and busy. They are focused on larger complex claims because that's where the money is.

If your estimate writer is a PA and they tell you, "that's a waste of time", or "we can't get that", it's because they don't have plays that can win.

The truth is the best PAs are not available for smaller claims, claims under $100k and maybe not available for claims less than $150k or more.

Solution: What you need is a system designed for your situation to cut the wasted BS and get results.

Solution: Our GamePlan is customized to your needs.

Problem: Estimate Inconsistency

Most Xactimate users don't understand Xactimate. People that get certified have convinced the general public that the Xactimate certification is a big deal. IT'S NOT! It's not because it's a tutorial on the software not on claims. Repairing something is not consistent with the policy, restoring the material or products useful life is. Xactimate does not teach that. You only get that from the Pros.Problem: Many contractors, estimate writers, insurance liaisons, and public adjusters are afraid to use Xactimate right because they don't want to upset the adjuster. "Let's not make waves... we want the adjuster to like us." It's because they are clueless. They do not have a playbook or an effective game plan. They are running the carrier's plays. They are landing exactly where the carrier wants them to land. They believe 15% - 20% 30% or even 50% is a big deal. IT'S NOT.

Problem: Many contractors have learned their workflow and game plan from companies they used to work for, from adjusters, from PAs that were trained by carriers. These so called experts are NOT.

There is a Game Plan that works and it's not what they are selling.

It's is not about wanted to be friendly with adjusters or purposely pissing off adjusters or being bull headed. The problem is they don't understand the REAL GAME GOING ON.Problem: There are adjusters, and there are appraisers and even umpires that refuse to be fair to some contractors because the contractors inconsistency makes them appear to be untrustworthy.

Solution: A GamePlan carefully crafted to based on the REAL GAME, with a consistent and optimal workflow and a GamePlan customized to your construction compan's objectives using proven plays to win Claim Success. It gets more without compromising the insured or your contractor business.

Solution: There are adjusters, and there are appraisers and even umpires that refuse to be fair to some contractors because the contractors inconsistency makes them appear to be untrustworthy.

Solution: Understanding the REAL Game, following a consistent Workflow and running effective plays from a proven GamePlan outperforms the alternatives.

Problem: The staggering amount of time communicating with the adjusters.

Many adjusters are just towing the company line. Many don't respond timely or even at all.Problem: Some adjusters, and it seems more and more, prefer to drag out your claim because it leads to fractures between insured and contractor. In fact some adjusters actively attempt to drive a wedge between the insured and the contractor sowing mistrust.

Problem: Some adjusters and carriers playbooks include plays to deny now knowing they will give up some later. They know what to deny and will make sure as much time as possible passes before they compromise.

Problem: Carriers do not play fair because you don't know the rules.

Solution: A Workflow & GamePlan that shows your the real game, shows you the plays the carrier is most likely to run, customizes plays for your own GamePlan so that every claim is winnable.

Problem: The insured needs more handholding than your team is capable of. They are asking questions your salespeople can't answer. Your sales teams lack of ability and time allows the adjuster is persuading them and driving them to believe you are the problem

Your team is dealing with adjusters trying to persuade the insured your company is wrong or worse dishonest. Perhaps worse is when the insured wants to be left alone and wants your team to handle everything until one day they wake up and think you haven't been communicating enough and they are now angry and feel you are NOT doing your job. Again, it very well maybe the adjuster ran a few plays to cause this. The claim stalls because the adjuster hasn't responded then when they do they ask for more info, info your team has already have sent or info you likely can't get. Their plays are meant to stymie your efforts and to cast doubt on you. The carrier's playbook has a multitude of plays and their demands and requests can seem endless.

Solution: A Workflow & GamePlan that exposes their plays and wins the approval of the insured. It activates the insured to be a team player and proponent and even includes plays the insured can run. The insured does not have to know everything but if they get clued into the game they gain faith in you. If you expose the other side to them, the gain faith and belief in you, if you provide them samples of what has worked for other insureds they buy in.

There's a different way.

There's a better way.

Substantiated Estimates Win

We can help!

Carriers requiring stricter documentation

You Scope with our help, We Estimate,

We Collect, You Complete

A Winning Formula

A cost-effective solution for contractors who want cost affective fair settlements.

Claim Success and Winning a claim as defined by us is a fair claim settlement for the insured.

A claim settlement that allows the insured's property to be properly restored.

Insurance Claim Restoration with Excellent Outcomes

Substanciated Restoration Estimates -

Substanciated Estimate/Cost Comparisons - Expert coordination, Review, & Management - Pre-Appraisal Review, Prep, & Position Substanciation - Insurance Coordination, Management, & Collections

Step off the treadmill and let the expert take over.

Tired of adjuster tactics attempting to constantly stifle the claim in an attempt to frustrate your efforts, cost you time and money, & force your and the insured to accept their unfair estimate amount.

Tired of adjusters lowballing estimates then creating walls and barrios between you and a fair outcome.

Tired or the treadmill?

If you like the outcomes that most estimate writers provide -

You are going to LOVE these outcomes.

How much time do you, your staff, and your sales people spend trying to satisfy adjusters only to get less than you deserve?

We use tried and true plays from insurance insiders. Our system is different than anything you have ever seen. We know how insurance is supposed to work. We know where the common failures are and how to overcome delays and denials and the lowball insurance estimates. We know what works.

This is NOT Public Adjusting. You are not determining coverage. Your estimates evolve from your opinion to substantiated and reasonable.

The adjuster believes that contractors and insureds don't understand how the policy works. The claims department for the carrier, their supervisors, managers, and adjusters are all convinced that the information and sometimes misinformation they propagate has contractors and insureds running in circles, chasing their tails, wasting their time, and confounded when it comes to getting fair settlements.

Restoror.com provides administration, management, communications along with products, documents, and evidence to obtain fair settlements. Our services can be purchased piecemeal or as a system. Either way, our products/services are unparalleled.

When you rely solely or mostly on your opinions and Xactimate, you are playing the carrier's game, running the carriers plays. Restoror.com becomes an invisible part of your team bringing insurance expertise.

Our goal is to eliminating all of the wasted time you, your staff, your sales people spend to try to appease adjusters, alleviating huge chunks of hours from your daily workload so your sales team can focus on sales and completing projects.

This is not an "estimate writing service" or an "insurance Liaison service" . This is a game changer.

If your team is essentially working for the estimate writer or Insurance Liaison that costs you 10% or more getting results that are 20% to 35% on average with the occasional 50% increase and you are satisfied - why are you here?

That system is playing the carriers game and running the carriers plays. Team members providing inconsistent information to an estimate writer trained by and trying the please the carriers .

You need a Workflow that is easy to follow and brings better results. This GamePlan is customized to you, it's part of your team, you reap the rewards. It becomes an extension of your company, a part of your team, and our expertise reduces your team's load, increases your teams efficiency and production, while minimizing your staff's non productive or less productive time. Alleviating the chaos and maximizing the your sales, job completions, and profits.

Most contractors get 20% to 30% more than the adjuster's initial estimate, on average. Most contractors believe getting 30% to 50% more than the initial insurance estimate is great. That is only good when you don't know the rules and play the wrong plays.

Claim Success Workflow GamePlan produces much greater results.

When you have the rules, run the right plays, your efficiency and revenues skyrockets. If you spend 50% less time on each claim, would you sell 100% more jobs?

Estimate Comparison Report.

Disputes cannot be resolved until the differences are clearly identified and the position proven to be reasonable.

Restoror can provide a variety of reports.

Without Site Inspection: We provide a Comparison Report based on the information we receive with no onsite inspection.

With Site Inspection: We investigate and provide an expert level cost estimate, compare our estimate to the carrier's position, then we provide both our estimate and the Comparison Report.

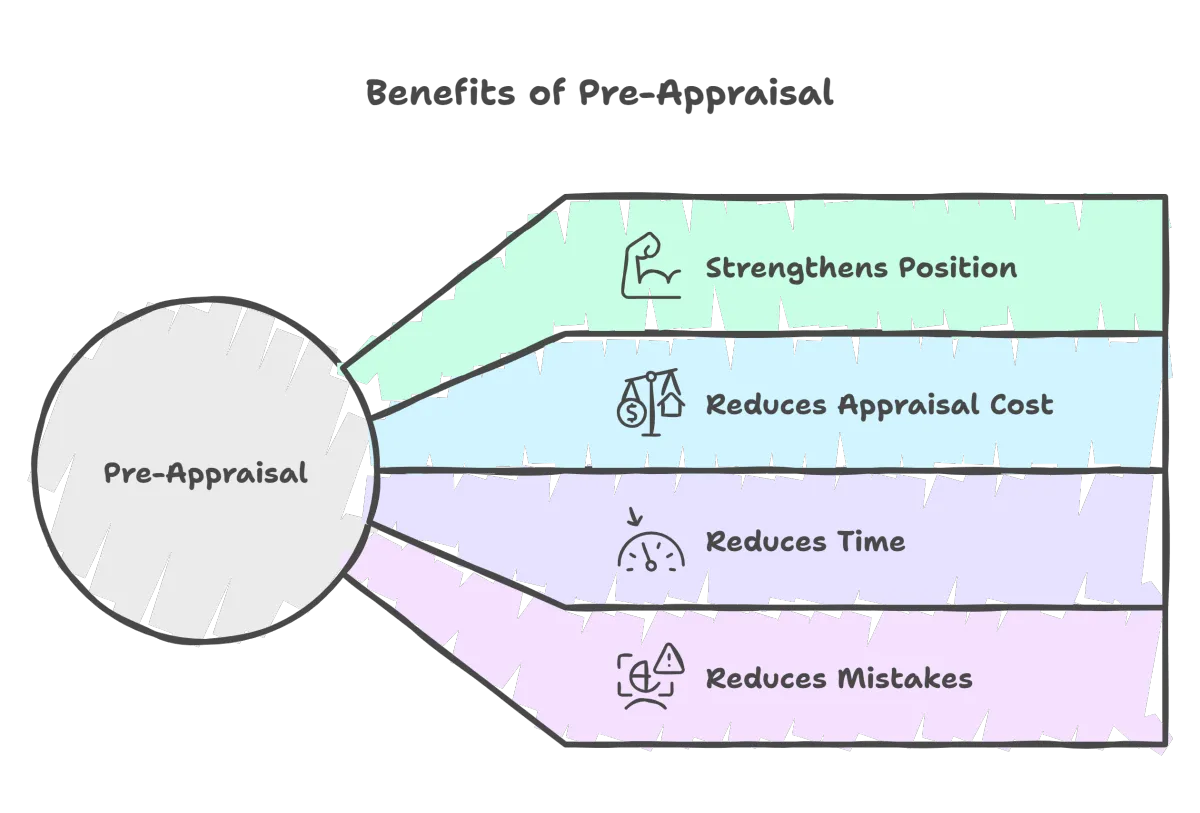

Pre-Appraisal Review or Review & Position Substantiation.

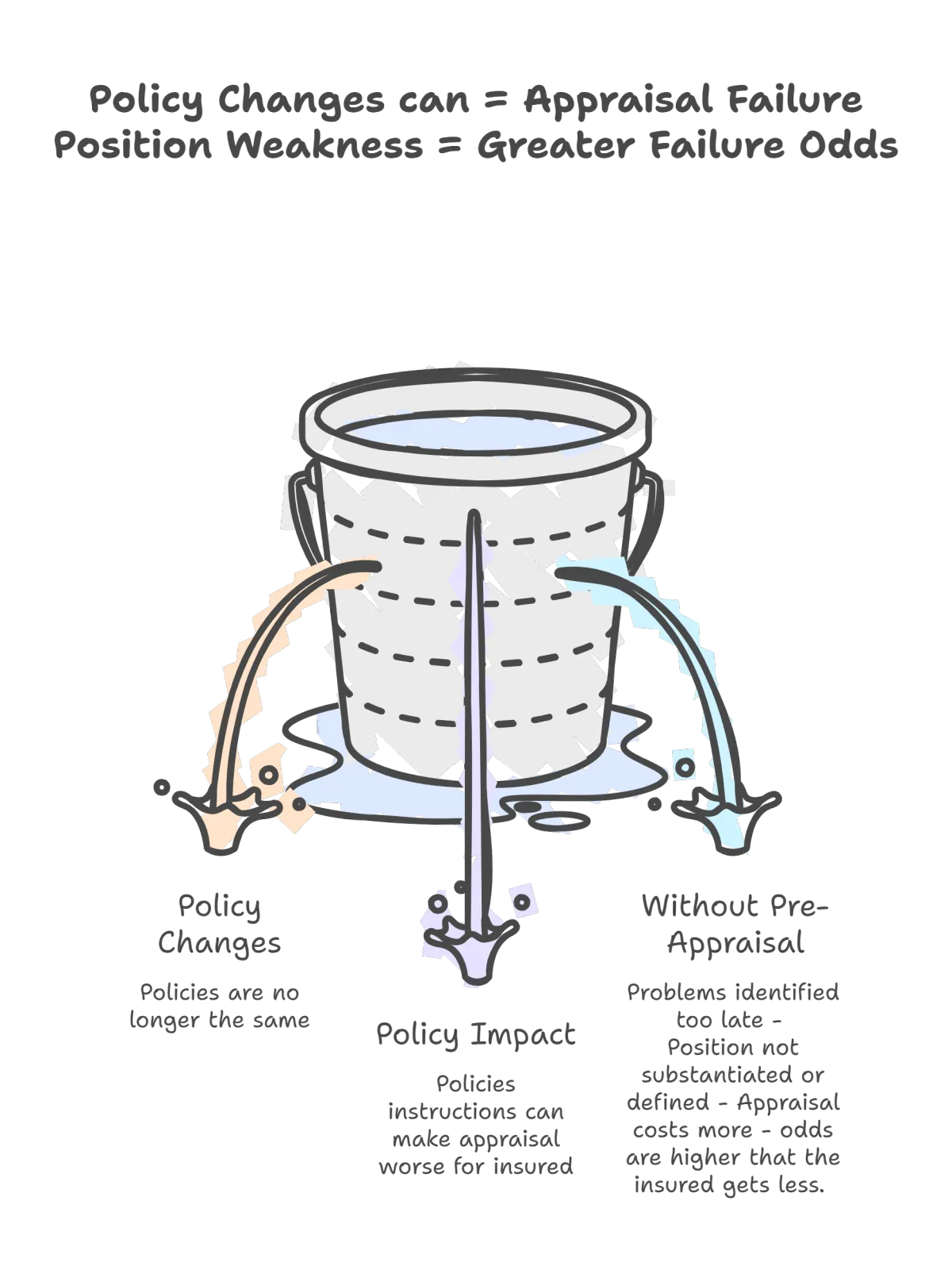

Before you agree to or invoke an insurance appraisal, don't... NOT without making sure the insured's position includes everything it should and nothing it shouldn't.

The days of one paragraph appraisals are no longer always the case. There are appraisal clauses that may make invoking or agreeing to appraisal a mistake, unless you know the traps and weaknesses and can use them to create a memorandum that levels the appraisal process, making it more fair and less onerous or objectionable.

We would always advise every insured, every contractor, every attorney to thoroughly read the appraisal clause when considering invoking or agreeing to an appraisal. Make sure the insured's position is well prepared prior to invoking or agreeing to appraisal. Because some appraisal clauses are a detriment and a disadvantage to some insureds, and some claims, it is extremely important that the appraisal be vetted first.

Some policies dictate that the insured determine exactly what is being disputed, including naming all components and parts:

Sample Excerpt from a Farmers/Foremost Policy: The appraisers shall determine the incurred property damage, If any, to each of the component parts of that property for which you have claimed loss, and the actual cash value of the incurred property damage, as of date of the loss. In

determining the actual cash value of the incurred property damage, the appraisers shall only use reasonable costs of materials of like kind and quality unless the policy expressly provides otherwise.

The appraisal shall separately state and itemize the following for each individual component part of the incurred property damage:

i. a description of each component part of the property;

ii. a description of the distinct and demonstrable physical injury to or destruction of each component part, if any, without reference to

what caused the damage;

iii. a description of the reasonably necessary repairs or replacements for each component part of property;

iv. the estimated costs of the reasonably necessary repairs or replacement(s) to each component part of property;

v. the estimated amount of proper depreciation and/or obsolescence to each component part of property; and

vi. the actual cash value of the incurred property damage.

Evidence of the reasonableness of the costs, and evidence that the materials are of like kind and quality, if the policy loss settlement requires like kind and quality settlement, shall also be included with the appraisal.

Don't assume your appraiser is ready for these policies and the appraisal processes the policy mandates.

Many appraisers are poorly trained, have not been certified and lack the abilities necessary for some appraisals.

If the appraiser believes they can treat every appraisal the same, they are living in the past. We have WITNESSED appraisers hired by insureds behaving as though they don't have to adhere to these appraisal clauses.

The appraisal clause above can be ignored and could result in an acceptable appraisal award, though, if the carrier doesn't agree, they will likely be looking into whether the appraiser has actually stayed within their authority and adhered to the appraisal clause details.

This is not your daddy's Oldsmobile!

Besides vetting the claim, the insured's position, some clauses may strip the appraiser of making determinations though allow the insured to make those determinations. In these claims it's best to have these determinations proven before appraisal. Some clauses may impede the appraisers from normal appraisal protocols.

In this case, if you make sure the insured's position includes component descriptions, if they are damaged or affected and how, why the method estimated is reasonable for each component, and the costs to each component along with the evidence of reasonableness will not only save the appraiser time that will be billed to the insured, it will help to clarify the insured's position and make it easier for it to be deemed reasonable by the insured's appraiser and help the insured's appraiser present it to the carrier appraiser and if necessary the umpire.

Some carriers have modified their appraisal clause resulting is a much more complicated appraisal process that if not followed exactly can subject the award to a legal battle to Overturn OR Vacate it.

Do you want toi pay for an appraisal to have it thrown out?

Review Without Site Inspection:

We create a Pre-Appraisal cost Report substantiating the insured's position, differences, proven to be reasonable and well substantiated. The estimate is based on deductions made from the information we receive with no onsite inspection.

Review With Site Inspection: We investigate onsite, identify damages reasonably associates with the peril in question, we identify materials affected, obtain the manufacturer's instructions for all materials affected, identify relevant building codes, determine reasonable quantities of materials, then create an expert level cost estimate proven to be reasonable and well substantiated.

Review & Report Without Site Inspection:

We create a Pre-Appraisal cost Report substantiating the insured's position, differences, proven to be reasonable and well substantiated. The estimate is based on deductions made from the information we receive with no onsite inspection.

Review & Report With Site Inspection:

We investigate onsite, identify damages reasonably associates with the peril in question, we identify materials affected, obtain the manufacturer's instructions for all materials affected, identify relevant building codes, determine reasonable quantities of materials, then create an expert level cost estimate proven to be reasonable and well substantiated.

We offer some services to all contractors

We offer our premier services to our Members ONLY

We allow a limited number of contractors to become members each month.

Start the Process Now.

More Efficient & More Valuable

Restoror.com is an invisible extension of the restoration business

Substantiated Cost Estimates.

Many contractors' estimates can easily be proven to be inadequate, inaccurate, and more importantly, unreasonable.

The number 1 reason contractors do not get their estimates accepted by carriers is because they do not prove their estimate is reasonable.

Restoror.com estimates are Substantiated and they are proven to be reasonable.

A reasonable estimate does not mean the full cost of the estimate is covered by the policy the insured purchased. You are demonstrating proper restoration and backing it up.

You cannot affect what policy the insured bought and more and more insureds by worse and worse policies.

Options:

1) engage us to provide a substantiated estimate based on the information we receive from you,

2) engage us to investigate and provide an expert substantiated cost estimate.

Estimate/Cost Comparisons.

Disputes cannot be resolved until the differences are clearly identified and the position proven to be reasonable.

Restoror.com provides both brief comparisons clearly demonstrating differences as well as detailed substantiated comparisons where each position difference is substantiated and proven reasonable.

1) engage us to provide a comparison based on the the carrier's estimate and the contractors estimated costs that we receive,

2) engage us to investigate and provide an expert substantiated cost estimate and a comparison based on the the carrier's estimated costs and the substantiate estimate we created to produce a Differences Report, and then we work with the carrier to obtain approvals.

Pre-Appraisal Review & Position Substantiation.

Insurance appraisals have changed. Not every claim is right for appraisal. Don't waste your money or the insured's money on an appraisal that is a detriment to the insured's claim success.

If you believe your project is at an impasse then quit wasting your time going back and forth with an adjuster. That will not help your position and it maybe hurting it.

Appraisals are successful when the insured's position is defined and substantiated and the differences identified clearly along with the proof that the insured's position is reasonable on each one. This provides the insured's appraiser with evidence and reduces the time the appraiser would have had in developing the evidence for their position. It's much easier and takes less time to verify than to develop.

Appraiser's are supposed to be impartial and must have their own position, They are not advocates for the insured or the carrier. Though that doesn't mean the insured providing a strong position is not an advantage to the insured and helpful to the insured's appraiser. Providing a solid well documented position means that the appraiser's time is reduced and the less time spent means a smaller invoice at the end. It also means a greater chance the two appraisers can agree and if need be a greater chance the umpire will appreciate the substantiated position.

Expert Coordination, Review & Management.

Sometimes experts are needed. Contractors tend to shy away from experts because of a common misunderstanding.

Most contractors believe that they are the expert and what they estimate is reasonable because they said so, and because they use Xactimate.

None of that matters.

Why?

Because experts are impartial, nonbiased. The contractor cannot be impartial. They can't be considered an expert because you have a stake in the outcome.

On the other hand, the use of free and low cost experts happens every day though few contractors know how to capitalize on them.

An estimate built on the shoulders of experts, substantiated and proven to be reasonable, is much more likely to prevail.

Competative Estimates.

Have you ever had an insurance company have one of their preferred contractors inspect and write an estimate on behalf of the carrier?

Can it be defeated or are you stuck with their lowball insurance friendly estimate?

You are not stuck. We know how to demonstrate that their estimate is not reasonable.

We may have the ability to provide competitive estimates that demonstrate that your costs are reasonable. (This service for members only)

It Works!

Insurance Management, Coordination, & Organization

This is our premier service, with this service all other services are included. This service is a membership service and is the best of it's kind in the country. It is offered to members only.

This service changes your construction companies insurance administration into a fine tuned, efficient, vehicle that consistently wins at an affective cost.

What we do doesn't fit here nor would we want to summarize it here.

We are insiders with true insurance expertise. We have taught adjusters, independent adjusters, and public adjusters. We have been called on to be the insurance companies problem solver.

Our knowledge is not that of an average adjuster that got their license in Florida or Texas or both and worked a few years as an IA.

We were trained by the best in the country, and attained a level the average adjuster cannot comprehend. In fact, most claim supervisors and managers do not have the information we have.

The truth is we are sought after and so we are selective. We work with honest and ethical contractors that are striving & aspiring to be the best at what they do.

We Rate our contractors A, B C, & D. We will not work with D. We work with C as they learn to become B and we want every contractor to be A.

The Rating is based on quality of work and whether your business follows manufacturer's instructions and the codes when the settlement is fair enough to afford you to.

Membership fees are based on value we deliver. They are always fair but can differ from company to company and person to person.

Your Restoration Business & Restoror.com

“Structured System,” “Efficient Insurance Management,”

“Excellent Leadership,” “Well-Organized"

"Results Driven Support.”

Designed for Better Outcomes

Collaborative, Results-Driven

Efficiency and Scalability

Integrated

Expertise